Solana (SOL) prices are on the rise

Solana (SOL) has made some notable advances in security over the past few months. These could have a positive long-term effect on the price of the cryptocurrency. In this article, we take a look at two important developments: the improvements in the security of the network and the impact on the total value locked of the Solana blockchain . Furthermore, we will take a detailed look at the Solana (SOL) price itself in our chart analysis .

Improvement of the Solana blockchain: SOL price increases

Network security is critical to the widespread adoption of Solana. Fortunately, a number of improvements will soon be implemented to make Solana more secure – both for the network as a whole and for users.

The Solana developers have been working hard over the past few months to improve the reliability of the network. In 2022, a series of bugs brought the Solana network to a standstill. As a result, Solana’s core team focused on improving network reliability. Some of these bugs that were encountered were new, while others were the result of exponentially increasing usage of the network.

Network upgrades that have already been introduced or are about to be introduced include QUIC , a protocol written by Google that enables fast asynchronous communication . Furthermore, a so-called stake-weighted Quality of Service (QoS) was implemented. This prevents unstaked or low-stake nodes from spamming others. Furthermore, local hubs for trade were introduced. This allows users to pay a little more SOL to have their transactions processed on the Solana blockchain first.

Solana total value locked on chain more than doubled since early 2023

With improvements to the Solana blockchain, total value locked has increased significantly. The Total Value Locked (TVL) is an important indicator of the health and growth of a blockchain network. It measures the total value of all cryptocurrencies locked in smart contracts , DeFi applications and other types of blockchain-based systems.

In the case of Solana, TVL has more than doubled from $400 million to over $800 million since 2023, according to DefiLama . This shows that despite the challenges it has faced, the network continues to grow and be embraced by users . This growth could be partly due to the improvements in network security , which increases users’ trust in the network and encourages them to lock their tokens in Solana-based applications.

A higher TVL value can also indicate that the network has greater liquidity, making it more attractive to users as they can more easily exchange their cryptocurrencies for other assets. In addition, higher liquidity can help improve price stability and reduce the risk of price volatility.

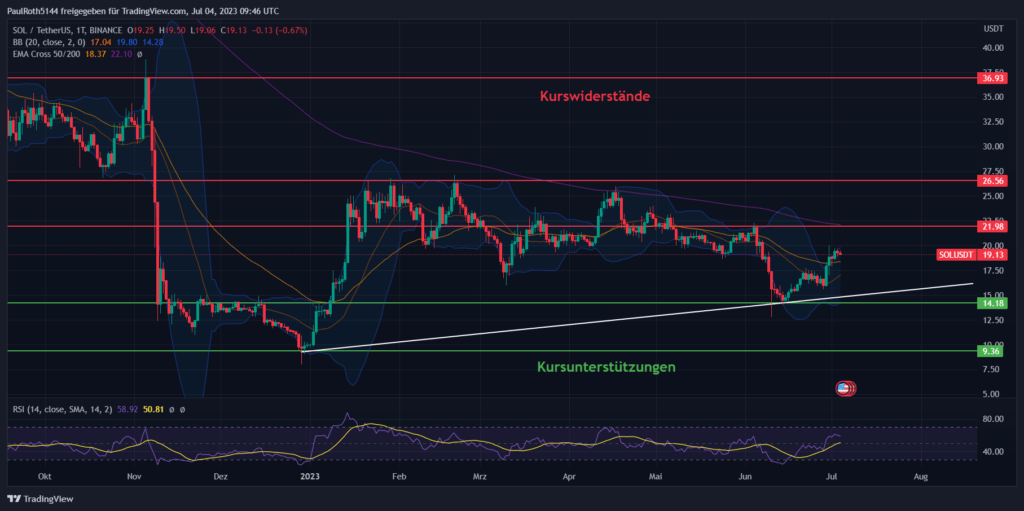

Current technical analysis of the Solana (SOL) course

Solana (SOL) technical analysis paints a mixed picture. On the one hand, there are positive signals, such as the recent safety improvements, which strengthen the SOL price. On the other hand, the Solana (SOL) price remains in a strong long-term downtrend. At the time of writing, SOL is trading at around $19.15.

Solana has been on a general downtrend since June 2022, however, it has been stabilizing since then. A short-term uptrend has established itself with an uptrend line. The SOL course managed to push through a higher low. A key support for the Solana price is $15. A key resistance will be found at $21 on the Solana chart analysis.

In summary, Solana shows poor price performance over the long term. In the short term, the SOL Coin managed to stabilize and record price gains continuously. Despite the general volatility of the crypto market, Solana has shown some stability over the past few months. This could be due to the positive developments in the Solana ecosystem just discussed.

Overall, the technical analysis seems to indicate that SOL price has the potential to continue higher. If the Solana blockchain continues to prove secure, more investors may be tempted to buy Solana .

Conclusion and forecast for the Solana (SOL) course

Recent developments at Solana, including improvements in network security and Hivemapper integration, could help strengthen the SOL course. While the cryptocurrency markets remain volatile, these positive developments could help boost investor confidence in Solana and support the cryptocurrency’s price. At the time of writing, SOL is priced at around $19.15. It remains to be seen how these developments will affect the SOL price, but the prospects for Solana appear promising.