Aave (AAVE): Growth in the DeFi sector makes AAVE Coin take off

The DeFi world has witnessed a remarkable rally over the past few weeks, with Aave (AAVE) being one of the cryptocurrencies that has shown outstanding performance in the sector. But what is behind this upswing?

DeFi boom: AAVE cryptocurrency ecosystem is growing

Aave, a leading DeFi protocol, has made significant strides over the past few months that may have had a positive impact on AAVE’s price.

In April 2023, the Aave Grants DAO (AGD) published its seventh quarterly report. The report covered grant distribution, recent event sponsorships, a budget breakdown and operational updates. Seven projects contributing to the development of the ecosystem received a total of $93,000 in funding. These projects range from developing risk management tools to sponsoring blockchain education events.

Further, in January 2023, it was proposed to implement the latest version of the protocol on Ethereum. This development could help improve the protocol’s efficiency and security, and could further increase user confidence in the protocol.

Another important factor that may have impacted the price of AAVE is the significant increase in Total Locked Values (TVL) in Aave. Since 2023, TVL in Aave has more than doubled from $400 million to over $800 million, according to DefiLama . This shows the growing trust and usage of the Aave protocol.

These developments have certainly helped boost investor confidence in Aave and boosted the price of AAVE Coin.

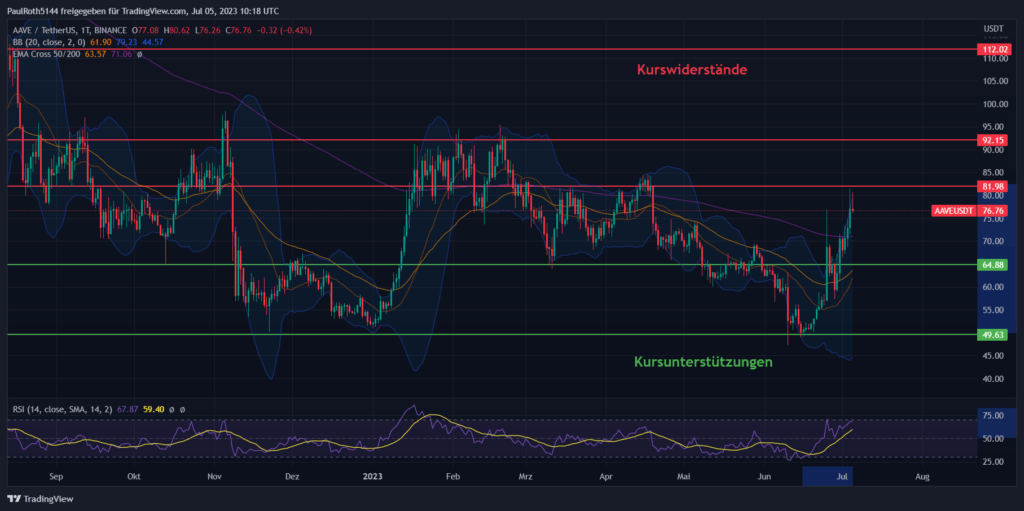

Current technical analysis for the Aave (AAVE) course

Aave’s technical analysis (TA) shows an interesting dynamic. After a long-term downtrend that gripped most of the market, Aave has been showing a sideways trend on the daily chart since December 2022. This sideways trend has established key support at $50, which was retested in mid-June. Since that test, Aave has posted impressive gains of over 65%.

Aave is currently testing a key resistance level at $85. It will be crucial to watch how the Aave price behaves at this point. A break could signal further gains, while a failure could indicate that consolidation or even a reversal is imminent.

Another important element of technical analysis is the Relative Strength Index (RSI). The RSI is a momentum indicator that measures the speed and change in price movements. A high RSI reading (typically above 70) can indicate an asset is overbought and a correction may be imminent, while a low RSI reading (typically below 30) can indicate an asset is oversold and an upward move might be imminent . Currently, Aave’s RSI stands at 69, which suggests that the market is strongly bullish, but also that overheating and a possible correction may be imminent.

In summary, despite the general downtrend in the crypto market, Aave is showing a remarkable recovery and stabilization. Short-term performance is impressive and current technical analysis suggests there is room for further gains. However, caution is advised as the high RSI reading indicates possible overheating. As always, it is important to closely monitor market developments and base investment decisions on thorough analysis and risk assessment.

Conclusion and forecast for the Aave course

Recent developments in the Aave ecosystem have had a positive impact on the Aave course. These include but are not limited to the increasing adoption of DeFi, the improvements in the protocol, and the growing TVL. With the return to DeFi and falling reliance on centralized services and exchanges, interest in Aave and other DeFi projects has increased as a result.

We can see in the technical analysis that Aave is showing a remarkable recovery and stabilization despite the general downtrend in the crypto market. Aave price has been posting impressive gains since mid-June and it is currently testing a key resistance level at USD 85. The high RSI reading indicates strong bullish sentiment, but it also indicates possible overheating.

Considering these factors, Aave price could continue to rise in the near term, especially if the positive momentum in the DeFi sector continues and technical indicators remain bullish.