Coinbase is filing a motion to dismiss the lawsuit against the SEC

Coinbase is filing a motion to dismiss the lawsuit against the SEC. At the beginning of June, the authority filed a lawsuit against the US market leader for several alleged violations. World market leader Binance is also the target of similar allegations. Their motion to have the court case dismissed only recently failed.

Coinbase files motion to dismiss lawsuit against SEC

Crypto exchange Coinbase recently filed a motion to dismiss its lawsuit with the SEC. The stock exchange supervisory authority accused the company, among other things, of selling illegal securities – that’s what the SEC called twelve specific cryptocurrencies.

Coinbase considers this assessment unrealistic. In addition, the SEC is exceeding its legal powers – this is how Attorney Paul Grewal countered the lawsuit that the authority filed against the crypto exchange in early June.

Coinbase follows rival crypto exchange Binance, which was also sued by the SEC in early June. Binance filed an objection , which was dismissed in court as improper. The presiding judge considered the debate to be ethical rather than legally motivated.

Coinbase is now hoping for success with a similar objection, as Grewal announced on Twitter.

We always welcome dialogue with any regulator, including the SEC, and believe new laws and regulations are the way forward. But the claims in this case go well beyond existing law – and should be dismissed.

The basis for the dismissal is not entirely new. For months, critics have been accusing the SEC of intentionally misinterpreting the US securities law in order to expand its own supervision and thus exert greater political influence.

Critics are convinced that the Securities Act provides no basis for regulating cryptocurrencies or imposing measures on their creators.

SEC is not responsible

Paul Grewal, Coinbase’s General Counsel, offers additional arguments as to why the SEC’s lawsuit is not admissible. He argues that the SEC would have no authority to file a lawsuit at all, even if all allegations were true.

According to Grewal, this is due to the way the SEC works, which has recently been in breach of the law. For example, the SEC refuses to debate before filing lawsuits, which is normal practice. In this way, a consensus can often be reached without having to involve a court.

Even if the SEC were right that the assets and services it identified fall within its existing regulatory powers, this lawsuit must be dismissed on the independent grounds that it violates Coinbase’s due process rights and constitutes an extraordinary abuse of the represents legal process.

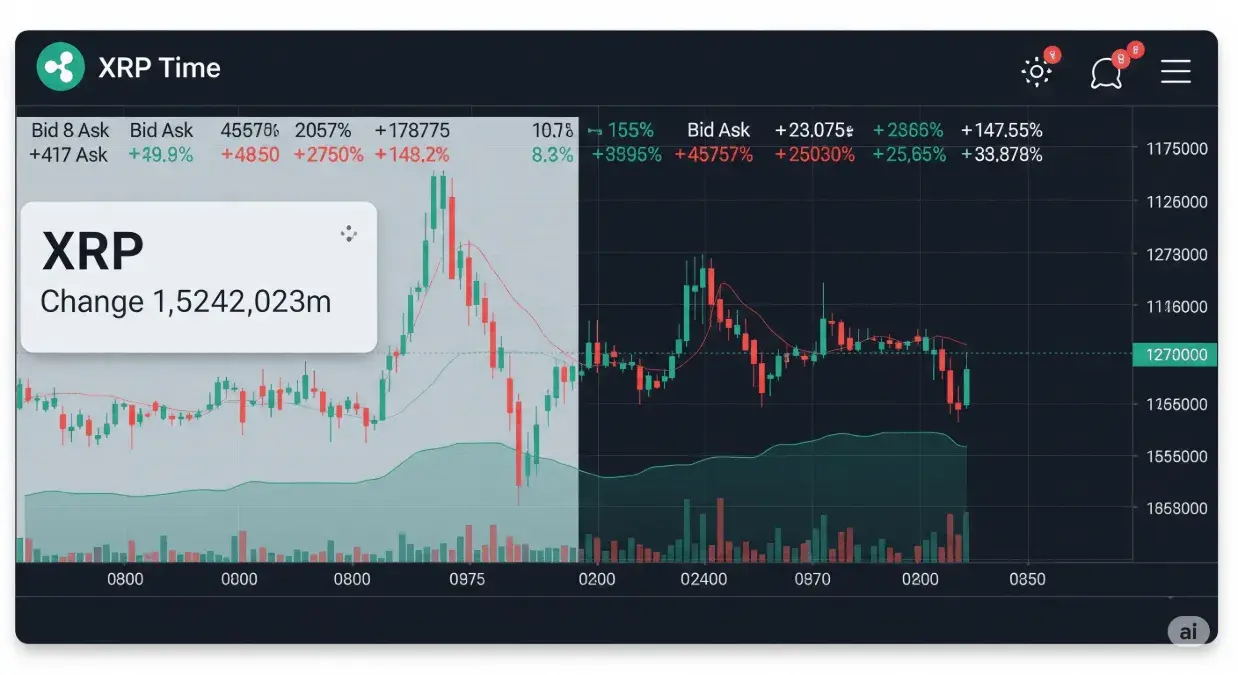

The crypto exchange also contradicts the accusation that Coinbase allowed the trading of illegal securities. The SEC has already named a number of cryptocurrencies that it classifies as unregistered securities. As a result, their prices collapsed significantly.

None of the assets identified by the SEC are actually securities, and for this reason and others, secondary transactions involving those assets are not securities either.

According to Coinbase, the fact that these are actually not securities is striking because several cryptocurrencies that have been accused of the same thing in the past are not part of the latest lawsuit from June.